No matter the state of the crypto market, certain currencies are resilient enough to stay afloat. Top on the list are Bitcoin (BTC) and Ethereum (ETH). Other cryptocurrencies have to compete to stay on the leaderboard as they respond to industry-related and macroeconomic factors.

For 2022, other currencies that were up the ladder include Tether (USDT), Binance Coin (BNB), Dogecoin (DOGE), and Polygon (MATIC). But before exploring these currencies, it is necessary to look at what cryptocurrencies are.

Table showing the top ten cryptocurrencies by market capitalization (Data culled from Coinmarketcap)

Cryptocurrencies are digital currencies, based on blockchain technology, that are exchanged without a third party, central authority, or government. They are secured by cryptography, thus it is almost impossible to fake or double-spend them. They provide a boundless, faster, and cheaper method for money transfers.

Market Cap: $447,617,284,851

No crypto has ever surpassed Bitcoin as the cryptocurrency with the largest market cap. It was created to allow people to make payments and exchange value without an intermediary. This is made possible through its network which allows these peer-to-peer transactions to take place.

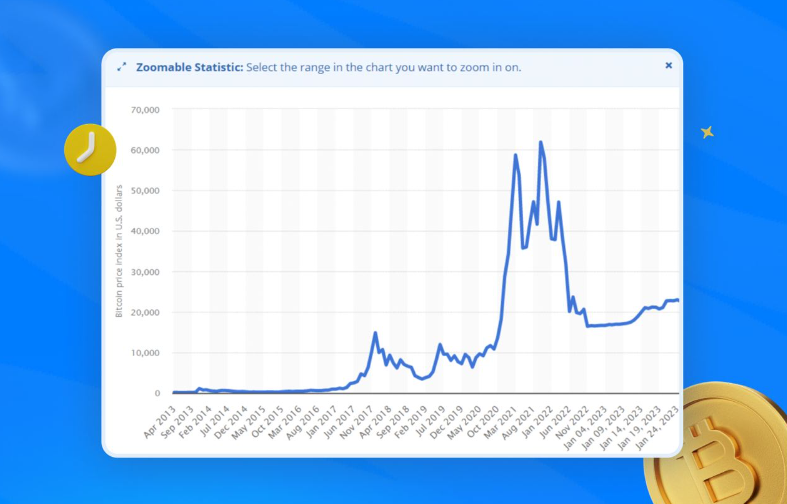

Bitcoin was launched by Satoshi Nakamoto in 2009. From having no value in 2009, it gained 2,960% within two months as it moved from $1 in April 2011 to $29.60 in June 2011. By the first quarter of 2017, it had hit $1000 and even skyrocketed to over $19,000 that year. In November 2021, Bitcoin reached an all-time high of $68,789.

2022 was a stark contrast to bitcoin’s 2021 performance. From over $37,000 in January, it plunged to around $20,000 in June. By November, it was trading at the $16,000 region.

However, it may seem as if things are beginning to take shape in 2023. Bitcoin opened the year at $16,547 but as of press time, Bitcoin trades at $23,226.

Market Cap: $196,858,130,740

Ethereum was designed as a platform where more decentralized solutions can be created. Its programmability, scalability, and security make it perfect for creating and launching an array of decentralized applications (DApps).

Ethereum came to the scene six years after Bitcoin and was priced below $1. But by 2016, it traded at $10. With the crypto boom of 2017, it skyrocketed to $774 and within the first quarter of 2018, it surpassed $1000. Furthermore, in November 2021, it joined Bitcoin to attain its all-time high of $4,815.

Ethereum traded at $2,610 in January 2022. By June, it had plummeted to $1,098. Then, it hovered between $1,200 and $1,600 from July to December. It has been moving between these price points since 2023 began. As of press time, Ethereum is valued at $1,607.

Market Cap: $67,198,903,346

Tether (USDT) is the oldest and most prominent stablecoin. It is pegged to the US Dollar. Therefore, 1 USDT approximately equals 1 USD.

As its name implies, a stablecoin is not expected to have significant price changes. Therefore, since its creation in 2015, USDT has maintained its value—not until 2022.

In May 2022, USDT fell briefly to $0.96 following the collapse of the algorithmic stablecoin, TerraUSD (UST). So far in 2023, the stablecoin is performing optimally. It is currently valued at $1 and has only seen a 7-day price change of 0.02%.

Market Cap: $48,028,195,848

Binance Coin (BNB) was launched as Binance’s native currency. BNB has found use as discounted transaction fees, payment for travel bookings, and other financial services that cut across various domains.

BNB was valued at $0.10 when it launched in 2017 during an ICO. Since then, it has climbed the price ladder gradually. It did not miss out on the 2021 price rally as it reached an all-time high of $623 in November.

Like every other coin that saw a rally in 2021, BNB’s value dipped in 2022. It traded at $378 in January 2022 and by December, it was at the $245 region. In 2023, BNB is already seeing some recovery. From opening the year at $246, it currently trades at $303 as of press time.

Market Cap: $43,643,030,002

Like USDT, USDC is a stablecoin pegged to the dollar. While USDT is issued by the company, Tether, USDC is issued by Centre, a consortium founded by Coinbase and Circle.

USDC was launched in 2018 and has grown to become the second-largest stablecoin.

Ironically, UST’s collapse favored USDC. Sequel to the collapse, USDC’s market cap moved from $48 billion to $56 billion. However, about $10 billion would be wiped off its market cap later that year.

As of writing, USDC is stable and valued at $1.

Market Cap: $20,937,971,357

The Ripple network offers fast, cost-effective, and energy-efficient financial transactions that are facilitated through its native token, XRP. XRP is a deflationary asset that becomes scarcer through a burning mechanism that removes it from circulation.

Ripple was launched in 2012, but 2017 was a defining year for the currency. It gained 51,709% that year, soaring from $0.006 to $3.40.

Since its 2017 rally, XRP has lost a significant chunk of its value. In 2022, it fell from $0.6 in January to $0.35 in December. However, it still maintains its spot in the list of top cryptocurrencies in the market. It has gained some value so far in 2023. As of press time, it was trading at $0.4122.

Market Cap: $15,578,420,594

BUSD is the third-largest stablecoin and is issued by Binance and Paxos. It is also pegged to the US Dollar.

Launched in 2019, BUSD hit a market cap of $100 million within a year. By January 2021, its market cap had increased 10-fold, touching $1 billion.

Despite the bear market, BUSD was able to hit a $20 billion market cap in September 2022. The Binance brand heightens investors’ confidence in BUSD as they believe it would not lose its peg. As of press time, Binance is valued at $1.

Market Cap: $12,987,872,665

Cardano is a proof-of-stake (PoS) blockchain that enables the creation of decentralized applications (DApps) and smart contracts. The Cardano network is powered by its native currency, ADA. ADA is used for transaction fees. It is also used by validators and delegators to secure the platform.

The creation of Cardano began in 2015 but it was launched in 2017. After its launch, ADA traded below $1 until February 2021 when it surged by almost 100% as it traded at $1.34. It climbed further to $2.73 in August 2021.

Like most currencies, 2022 was a bad year for ADA. It traded below $1 almost throughout the year and still trades below that even in 2023. As of press time, 1 ADA is worth $0.3755.

Market Cap: $11,392,563,380

Dogecoin was developed as a meme coin to taunt Bitcoin. But it was able to attract the attention of many within the crypto space, especially when Elon Musk picked interest in it.

DOGE was created in 2013 from Litecoin’s code to serve as an open-source currency for peer-to-peer transactions. DOGE has experienced significant price rallies since its creation. For instance, immediately after it was launched, it gained 1,061% in two weeks, moving from $0.0002 to $0.0023. Furthermore, during the 2017 bull run, it increased by 1,494%, peaking to $0.004. It plummeted in the same year but recovered in 2018 when it traded at $0.018.

Also, following Musk’s association with the coin in 2021, it gained 9,884% and reached an all-time high of $0.74.

DOGE’s price journey in 2022 was subpar. It dwindled from $0.14 in January to $0.07 in December. It hasn’t moved much from that price in 2023.

Market Cap: $8,760,341,277

Polygon uses the Ethereum network to connect Ethereum-based projects and make them flexible and scalable whilst they benefit from the security and interoperability of Ethereum’s structural architecture.

Polygon launched in 2017. However, MATIC, the ERC-20 governance token that secures the network launched in 2019. MATIC traded below $0.04 between 2019 and 2021. However, it had a meteoric rise of 7,000% in May 2021 as it hit an all-time high of $2.40.

MATIC fell from the $2 region in February 2022 to $0.3 in June. But it began to find its feet as the year drew to an end. By December, it was valued at $0.75 and grew in value into 2023. As of press time, MATIC is worth $1.

These are digital currencies whose transactions are verified and recorded by a digital ledger known as a blockchain. They allow peer-to-peer transactions that do not require an intermediary or centralized authority.

Cryptocurrencies are digital assets, while stocks represent a share of ownership in a company. Cryptocurrencies are more volatile than stocks. They also do not require commissions to trade them, unlike stocks in which brokerage fees apply.

Market capitalization reflects how large a cryptocurrency is. It is calculated by multiplying the unit price of the cryptocurrency by its circulating supply.

Circulating supply is the estimated number of coins that are circulating in the market. Total supply, on the other hand, is the total number of coins—both in and out of circulation, excluding those that have been burned.

Cryptocurrencies with the largest market caps in the market include Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Binance Coin (BNB), and Tether (USDT).

Cryptocurrencies are treated as capital assets, therefore it is required that traders and investors pay taxes on profits made from their investments.

Yes, there are various crypto ETFs such as the Bitwise 10 Crypto Index Fund and ProShares Bitcoin Strategy ETF.

You can buy cryptocurrencies on several centralized and decentralized exchanges.

This is because cryptocurrencies can be created by anyone once they have the know-how. Also, there is no institution that completely regulates the creation and issuance of cryptocurrencies.

Altcoins or alternative currencies are all currencies created after Bitcoin. Examples include Ethereum, Dogecoin, and Polygon.

Bitcoin is valuable because it embodies all the features of money. It is durable, portable, divisible, fungible, scarce, and accepted by a large number of people.

They are important because they provide a way for people to have full control over their finances. It also enables individuals to transact without needing a central authority.