The DeFi industry began only after the launch of the Ethereum blockchain in 2015. Ethereum’s introduction meant contracts could be agreed upon and signed on the blockchain, which inadvertently includes financial contracts could be made as well.

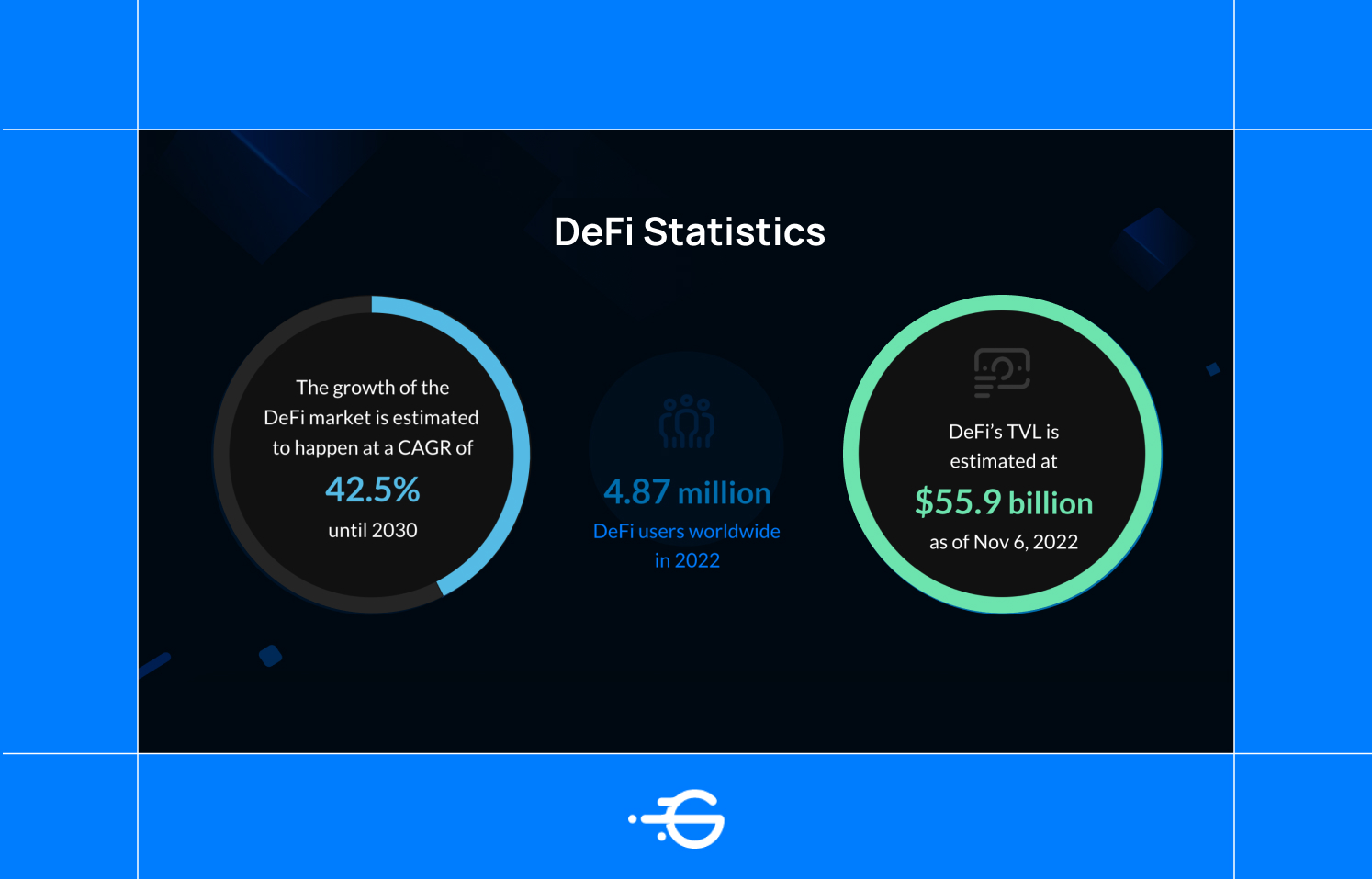

Now, eight years later, with nearly 5 million participants around the globe in 2022, decentralized finance is an undeniably large part of the Web3 sphere. Although the industry suffered over last year’s market downturn, January saw the DeFi ecosystem go on the rebound, kicking off 2023 with a major surge in its TVL. As decentralized finance sees more adoption among individual users and institutions, it is bound to expand even more. Indeed, the market is expected to hit a $231.19B valuation in 2030.

The term decentralized finance (DeFi) describes a financial model that utilizes blockchain technology, the same technology present in the crypto sector. Traditional systems of finance are centralized and controlled by intermediaries like banks and financial institutions. However, DeFi challenges the status quo and returns the power to individuals by offering open, and permissionless operations

Participants in decentralized finance can employ resident offerings without a middleman. That’s right, under the DeFi umbrella, individuals can carry out peer-to-peer (P2P) transactions. These are financial operations that occur directly between two participants, who also get to maintain custody of their own assets.

Decentralized finance makes it possible for individuals to transact as long as they have internet access wherever they are across the globe. Essentially, anyone can participate in DeFi applications and access financial services without the supervision of a central authority. The DeFi ecosystem features a broad range of products and services such as lending and borrowing, trading, and asset management among others. As stated earlier, DeFi uses blockchain technology to make this possible with smart contracts at the core of most offerings.

Top of the list is decentralization. DeFi is decentralized, meaning that it is not controlled by any single entity or authority. Instead, it is built on a blockchain network that is open and transparent, with transactions recorded on a public ledger.

DeFi applications are powered by smart contracts. These are self-executing programs that automatically enforce the terms of an agreement between parties. Smart contracts are tamper-proof and operate without a middleman, making them more efficient and secure than traditional legal contracts.

The open nature of DeFi allows anyone to participate in the network and develop new applications and services, driving innovation and competition. Transparency ensures that all transactions are recorded on a public ledger, promoting accountability and reducing the risk of fraud and corruption.

DeFi is not the same as crypto.

A cryptocurrency such as Bitcoin is a digital asset that uses cryptography to secure transactions and control the creation of new units. Meanwhile, decentralized finance is a blanket term for a broad range of mainly blockchain-based financial applications and services. DeFi in crypto often involves the use of cryptocurrencies as a means of exchange. The DeFi ecosystem makes use of these assets alongside smart contracts to provide services that run without intermediaries. DeFi uses cryptocurrencies and smart contracts to provide services that don't need intermediaries. Therefore, while cryptocurrency is one aspect of DeFi, there are several other components.

Bitcoin, the pioneer cryptocurrency emerged in response to a crisis in traditional financial systems. This crisis unveiled the need for an alternative financial model that could operate independently of the traditional banking system. Thus, the Bitcoin network emerged to offer an open, transparent, and decentralized system. Decentralized finance has the same goal. However, DeFi expands on the basic premise of Bitcoin to create an entire digital alternative to traditional financial institutions across the globe.

Some key DeFi offerings include:

With DeFi lending and borrowing services, you can lend out your crypto assets to earn interest or borrow assets using their existing crypto holdings as collateral. These platforms are typically powered by smart contracts, which automatically execute the terms of the loan agreement.

Stablecoins are cryptocurrencies that are designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. They are often used as a means of exchange or as a store of value within the DeFi ecosystem

DEXes make up a significant portion of the global DeFi market. These platforms allow users to trade cryptocurrencies and other digital assets without the need for a centralized exchange or intermediary. They operate on a peer-to-peer basis, using smart contracts to facilitate trades.

DeFi asset management platforms allow users to invest in a variety of cryptocurrency assets using a single platform. These platforms are typically powered by smart contracts, which execute investment strategies based on preDeFined rules and criteria.

Centralized Finance (CeFi) is the traditional financial system in which intermediaries such as banks and financial institutions act as gatekeepers and custodians of financial assets. In CeFi, financial transactions and assets are held and managed by third parties, who charge fees for their services.

The CeFi system is based on a hierarchical structure, where centralized authorities have full control over financial transactions and access to financial services. Although this system has been the dominant financial system for centuries, it has been criticized for being exclusionary, costly, and lacking transparency.

In the context of Web3, CeFi (Centralized Finance) refers to the use of centralized platforms to facilitate financial transactions in the digital sphere. It typically requires users to undergo KYC verification, similar to traditional banking processes.

While CeFi can provide a familiar and regulated environment for financial transactions, it relies on centralized entities to manage transactions, making it vulnerable to censorship, hacks, and other forms of disruption. Furthermore, CeFi often charges high fees for its services, limiting accessibility for many users.

A few CeFi platforms include Binance, Coinbase, and Gemini among others.

The core difference between CeFi and DeFi is that CeFi is centralized, meaning it relies on intermediaries such as banks and exchanges to manage financial transactions, while DeFi is decentralized, meaning it operates on a peer-to-peer basis without intermediaries.

Table showing the differences between centralized and centralized finance.

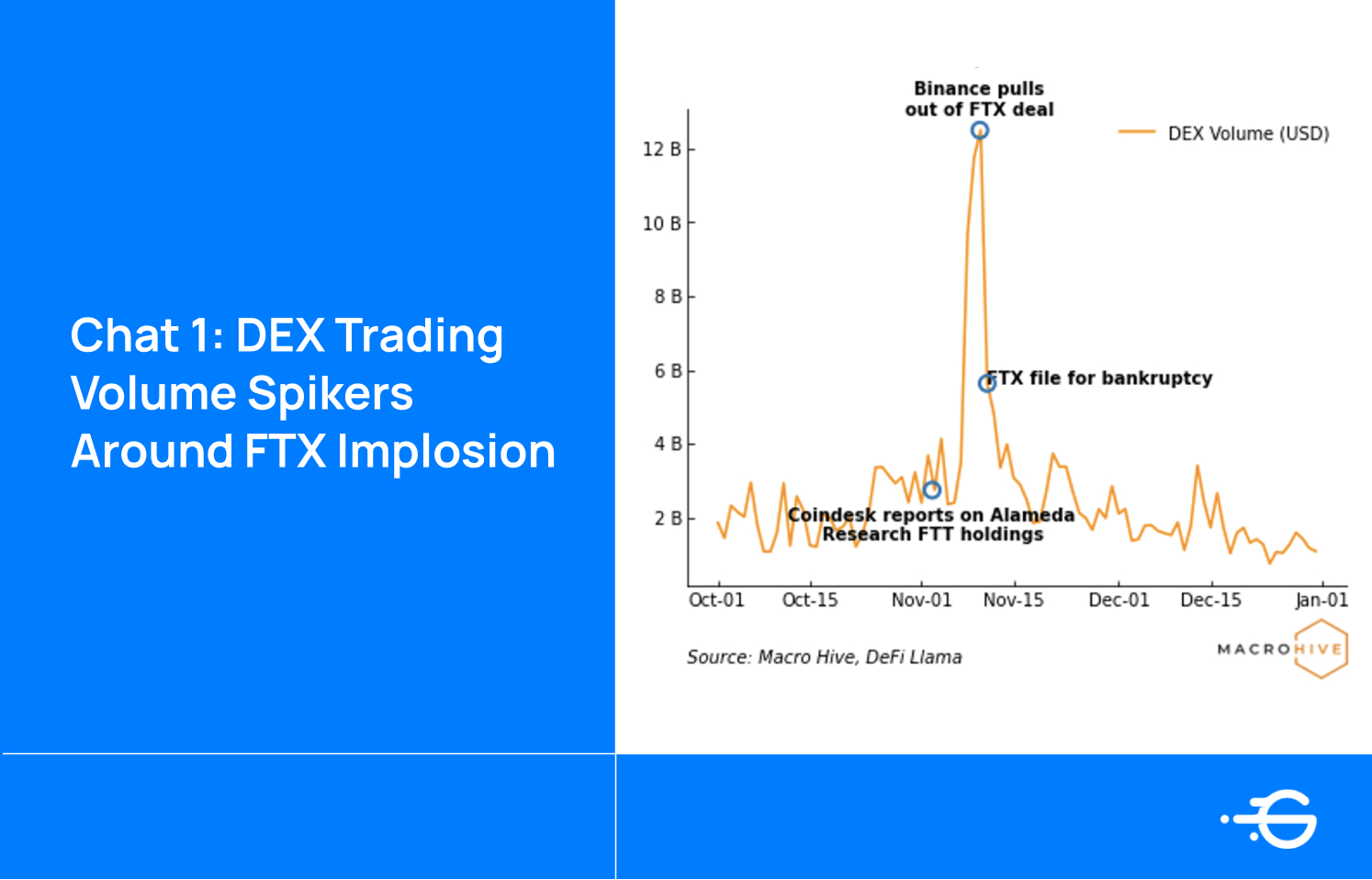

The collapse of the centralized exchange FTX was an important test for DeFi. Despite fears that investors might abandon crypto altogether, DEX trading volumes surged during the FTX debacle in November 2022. Many traders turned to DEXs as an alternative trading option less prone to centralization failures. Increased on-chain trading activity due to volatility, the need for liquidity, and the desire to reduce exposure to a single centralized exchange may also have contributed to the surge in DEX trading volumes during the FTX collapse. Therefore, the rise of DeFi and DEXs is worth considering for investors seeking alternative trading platforms that prioritize security and liquidity.

What is DeFi in blockchain?

A financial system built on blockchain technology that enables decentralized financial transactions.

What is DeFi trading?

Decentralized trading of digital assets without intermediaries.

How to get started with DeFi?

Open a digital wallet, fund it with digital assets, and access a DeFi platform. But research and understand the risks before investing.

What are the risks of using DeFi?

Smart contract vulnerabilities, liquidity issues, regulatory uncertainty, and lack of user protection.